Is Universal Music Group Stock on the Right Path to Recovery

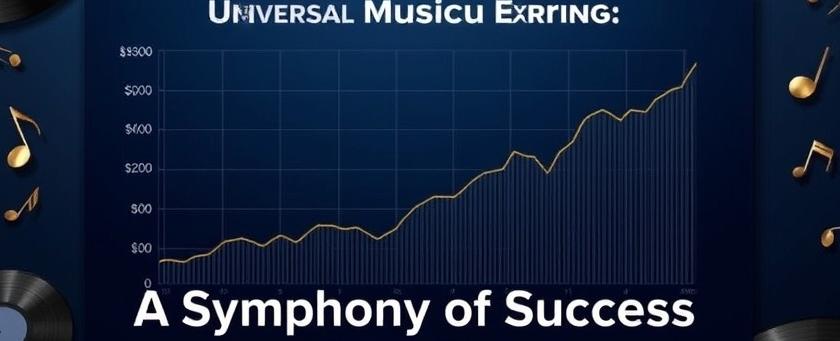

Understanding Universal Music Group’s Current Stock Performance

Universal Music Group (UMG) has been a focal point for investors, especially as the music industry continues to evolve in the digital age. With its latest quarterly results, many are left wondering: is UMG stock truly on the path to recovery? In this article, we will delve into the recent performance of UMG, analyze its financial health, and explore what the future might hold for this music giant.

Recent Financial Results: What Do They Indicate?

In the latest earnings report, UMG showcased some interesting figures. While the company has not yet reached its full potential, there are signs that it is moving in the right direction. Here are some key takeaways from the report:

- Revenue Growth: UMG reported a year-over-year revenue increase, driven largely by streaming services. This growth is crucial as digital music consumption continues to dominate the market.

- Profit Margins: Despite challenges, UMG maintained healthy profit margins, which is a positive indicator for investors.

- Market Position: UMG remains a leader in the global music market, holding a significant share that allows it to negotiate better deals with artists and platforms.

These results suggest that while UMG is not yet where it wants to be, it is definitely making strides towards recovery.

The Streaming Revolution: A Double-Edged Sword

The rise of streaming services has transformed the music industry. On one hand, it has opened new revenue streams for companies like UMG. On the other hand, it has also led to increased competition and changing consumer behaviors. Here’s how UMG is navigating this landscape:

- Partnerships with Streaming Platforms: UMG has established strong relationships with major streaming services, ensuring that its artists are prominently featured. This strategy not only boosts visibility but also enhances revenue.

- Diversification of Revenue Streams: Beyond streaming, UMG is exploring other avenues such as merchandise sales, live events, and licensing deals. This diversification is essential for long-term sustainability.

Challenges Ahead: What Investors Should Consider

While UMG shows promise, there are challenges that could impact its stock performance. Investors should be aware of the following:

- Competition: The music industry is crowded with competitors, including other major labels and independent artists. UMG must continuously innovate to stay ahead.

- Changing Consumer Preferences: As music consumption habits evolve, UMG needs to adapt its strategies to meet the demands of a younger audience that favors personalized experiences.

- Economic Factors: Global economic conditions can affect consumer spending on entertainment, which may impact UMG’s revenues.

These challenges present a mixed bag for investors, making it crucial to stay informed about market trends.

The Future of UMG: Is There Hope for Growth?

Looking ahead, the question remains: can UMG sustain its growth trajectory? Here are some factors that could influence its future:

- Investment in Technology: UMG is investing in technology to enhance its digital offerings. This includes better analytics for understanding consumer behavior and improving user experience on streaming platforms.

- Focus on Emerging Markets: As music consumption grows in emerging markets, UMG is strategically positioning itself to capitalize on these opportunities.

- Artist Development: By nurturing new talent and supporting existing artists, UMG can ensure a steady flow of content that keeps audiences engaged.

Conclusion: Should You Hold or Sell UMG Stock?

As we analyze Universal Music Group’s current standing, it’s clear that the company is on a journey of recovery. While it may not be there yet, the signs are promising. Investors need to weigh the potential risks against the opportunities that lie ahead.

In summary, UMG’s stock could be a worthwhile hold for those who believe in the long-term growth of the music industry. However, it’s essential to stay vigilant and keep an eye on market dynamics that could affect its performance.

For those interested in further reading, here are some recent articles that provide additional insights into the music industry and stock performance:

- The Future of Music Streaming: Trends to Watch

- How Major Labels Are Adapting to Digital Changes

- Investing in Music: Opportunities and Risks

Read on...

Table Of Contents

Legal Stuff