Is Russian Inflation Too High and What Does It Mean for the Economy

Understanding the Current State of Russian Inflation

As we delve into the complexities of Russian inflation, one question stands out: is it too high, and what implications does this have for the broader economy? Inflation rates have been a hot topic not just in Russia but globally, as they affect purchasing power, savings, and overall economic stability.

In recent months, Russia has been grappling with inflation rates that have raised eyebrows both domestically and internationally. The question arises: how does this inflation affect everyday citizens and the economy at large?

The Numbers Behind Russian Inflation

To grasp the situation, let’s look at the numbers. Recent data indicates that inflation in Russia has surged to levels that are concerning for both consumers and policymakers.

- Current Inflation Rate: As of early 2025, the inflation rate in Russia has reached approximately 12%, a significant increase from previous years.

- Historical Context: This rate is reminiscent of the inflation spikes seen in the early 1990s during the transition from communism to a market economy.

These figures prompt us to consider the broader implications. High inflation can erode purchasing power, making everyday goods and services more expensive for the average citizen.

The Impact on Consumers and Businesses

The effects of inflation are felt most acutely by consumers and businesses. For individuals, rising prices mean that their salaries may not stretch as far as they once did. This can lead to a decrease in overall consumer spending, which is vital for economic growth.

For businesses, high inflation can lead to increased costs of raw materials and labor. This often results in:

- Higher Prices for Goods: Companies may pass on the increased costs to consumers, leading to a cycle of rising prices.

- Reduced Profit Margins: Businesses may struggle to maintain profitability if they cannot raise prices in line with inflation.

Government Response to Inflation

In response to rising inflation, the Russian government has implemented several measures aimed at stabilizing the economy. These include:

- Interest Rate Adjustments: The Central Bank of Russia has raised interest rates to curb inflation. Higher interest rates can help cool off an overheating economy but may also slow down economic growth.

- Price Controls: In some sectors, the government has imposed price controls to prevent excessive price hikes, although this can lead to shortages and other market distortions.

However, these measures can be a double-edged sword. While they may provide short-term relief, they can also stifle economic growth in the long run.

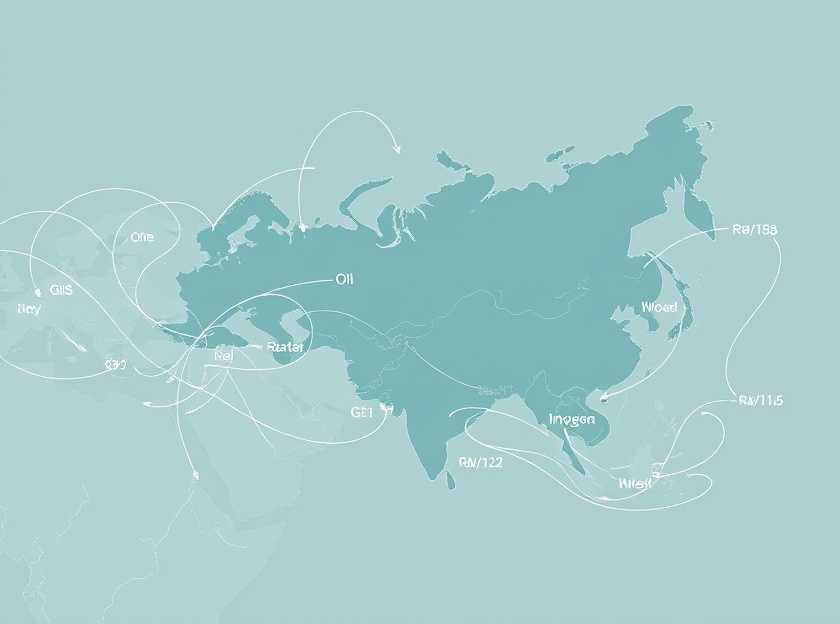

The Global Context of Russian Inflation

It’s essential to consider how Russian inflation fits into the global economic landscape. As countries around the world grapple with their own inflationary pressures, the interconnectedness of economies means that Russia’s situation can have ripple effects.

- Commodity Prices: Russia is a significant player in global energy markets. High inflation can affect oil and gas prices, which in turn impacts economies reliant on these resources.

- Trade Relations: As inflation rises, trade relations may become strained, particularly with countries that rely on Russian exports.

The Future of Russian Inflation: What Lies Ahead?

Looking ahead, the question remains: will Russian inflation continue to rise, or will it stabilize? Analysts are divided on the future trajectory of inflation in Russia. Some believe that the government’s measures will eventually bring inflation under control, while others warn of potential long-term economic challenges.

- Potential Stabilization: If the Central Bank’s measures prove effective, we could see inflation rates begin to decline in the coming months.

- Continued Volatility: Conversely, ongoing geopolitical tensions and global economic uncertainty could keep inflation rates high.

Ultimately, the future of Russian inflation is uncertain, but it is a critical issue that warrants close attention from both policymakers and citizens alike.

Final Thoughts

As we reflect on the current state of Russian inflation, it’s clear that this issue is multifaceted and complex. The implications for consumers, businesses, and the economy as a whole are significant.

Are we witnessing a temporary spike in inflation, or is this the beginning of a more prolonged economic challenge? Only time will tell, but one thing is certain: understanding the dynamics of inflation is crucial for navigating the economic landscape.

For further reading on inflation and its implications, check out these articles:

- Understanding Inflation: A Global Perspective

- The Economic Impact of Rising Prices

- Inflation Trends in Emerging Markets

Read on...

Table Of Contents

Legal Stuff