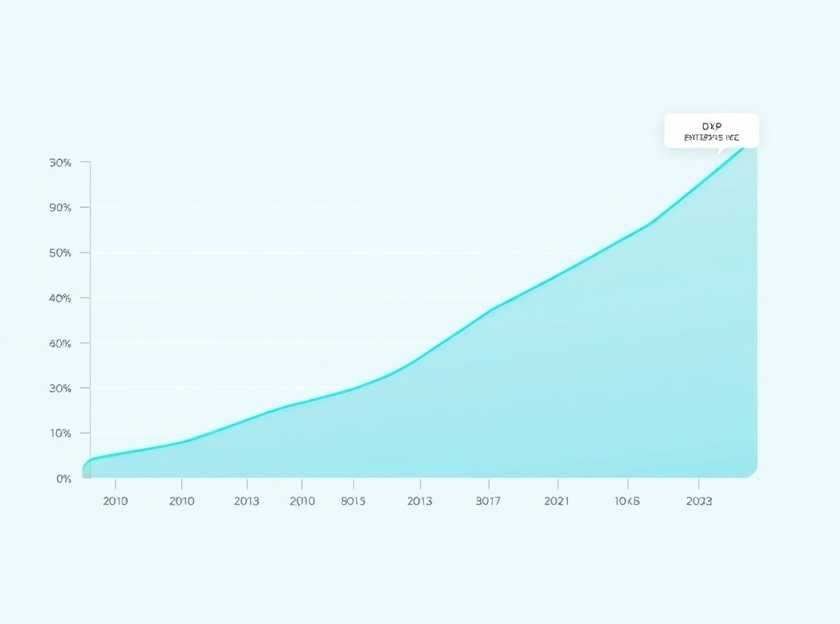

DXP Enterprises Inc Reports Q4 2024 Earnings What Investors Need to Know

Introduction to DXP Enterprises Inc

DXP Enterprises Inc, a leading provider of maintenance, repair, and operations (MRO) products and services, recently released its earnings report for the fourth quarter of 2024. Investors are keen to understand the implications of this report as it provides insights into the company’s performance and future prospects. In this article, we will delve into the key highlights from the earnings call, analyze the financial results, and discuss what these mean for current and potential investors.

Key Financial Highlights

During the Q4 2024 earnings call, DXP Enterprises reported several significant financial metrics that are crucial for investors to consider:

- Revenue Growth: The company reported a revenue increase of 15% year-over-year, reaching $200 million. This growth is attributed to increased demand in various sectors, including oil and gas, industrial, and chemical markets.

- Net Income: DXP’s net income for the quarter was $10 million, translating to earnings per share (EPS) of $0.50. This represents a substantial improvement compared to the previous year.

- Operating Margin: The operating margin improved to 12%, reflecting better cost management and operational efficiency.

These figures indicate that DXP Enterprises is not only growing but also improving its profitability, which is a positive sign for investors.

Market Response and Stock Performance

Following the earnings announcement, DXP Enterprises’ stock experienced a notable uptick. Investors reacted positively to the strong financial results and the company’s optimistic outlook for 2025. The stock price rose by 8% in after-hours trading, signaling renewed confidence in the company’s growth trajectory.

Factors Influencing Stock Performance

Several factors contributed to the positive market response:

- Strong Demand: The ongoing recovery in the energy sector has led to increased spending on MRO supplies, benefiting DXP Enterprises.

- Strategic Initiatives: The company’s focus on expanding its product offerings and enhancing customer service has resonated well with clients, leading to higher sales.

- Positive Guidance: Management provided an optimistic outlook for 2025, projecting continued revenue growth and margin expansion.

Operational Efficiency and Cost Management

One of the standout features of DXP Enterprises’ Q4 performance was its commitment to operational efficiency. The company has implemented several cost-cutting measures that have positively impacted its bottom line. These measures include:

- Streamlining Operations: DXP has focused on optimizing its supply chain and reducing overhead costs, which has improved its operating margins.

- Investing in Technology: The company has invested in technology to enhance its inventory management and customer service, leading to better operational performance.

These initiatives not only contribute to current profitability but also position DXP Enterprises for sustainable growth in the future.

Future Outlook and Strategic Initiatives

Looking ahead, DXP Enterprises has laid out a strategic plan to capitalize on its recent successes. Key initiatives include:

- Expansion into New Markets: The company aims to enter new geographical markets, particularly in international regions where demand for MRO products is growing.

- Product Diversification: DXP plans to expand its product portfolio to include more innovative solutions that cater to the evolving needs of its customers.

- Sustainability Efforts: With an increasing focus on sustainability, DXP is exploring eco-friendly product options to meet the demands of environmentally conscious consumers.

These strategic initiatives are expected to drive future growth and enhance shareholder value.

Conclusion: What Investors Should Consider

As DXP Enterprises Inc moves forward, investors should keep a close eye on the company’s execution of its strategic initiatives and its ability to maintain operational efficiency. The strong Q4 results provide a solid foundation, but the real test will be how well the company adapts to market changes and capitalizes on growth opportunities.

In summary, DXP Enterprises appears well-positioned for continued success in 2025, making it an attractive option for investors looking to capitalize on the recovery in the MRO sector.

For those considering an investment, it may be wise to monitor the company’s progress closely and evaluate how it navigates the challenges and opportunities that lie ahead.

Additional Reading

- Market Trends in MRO Sector

- DXP Enterprises Strategic Growth Plans

- Investing in Energy Sector Recovery

Read on...

Legal Stuff